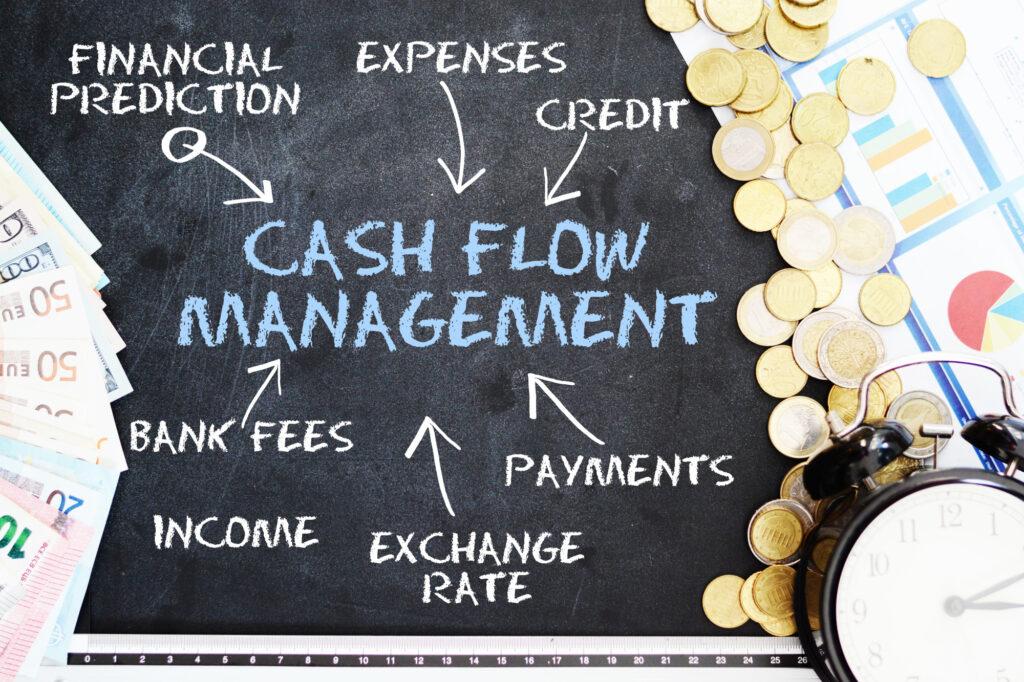

Have you ever looked at a company’s financial statement and felt like you were reading a foreign language? You’re not alone. Financial statements can be overwhelming and confusing, but understanding them is crucial for making informed financial decisions.

In this post, we’ll be focusing on the cash flow statement, and we promise to make it as fun and easy to understand as possible.

By the end of this post, you’ll be able to read and understand a cash flow statement like a pro, and you’ll have the knowledge you need to make informed decisions about investing, working with, or running your own business.

So grab a cup of coffee, and let’s dive into the exciting world of cash flow statements!

I. Introduction

A. Explanation of the importance of understanding cash flow:

Cash flow is the lifeblood of any business, large or small. It tells you how much money is coming in and going out, and helps you make informed decisions about how to manage your finances.

In order to be a successful business owner, you need to have a good understanding of how to read and interpret the cash flow statement.

B. Brief overview of the cash flow statement and its components:

The cash flow statement is a financial document that shows the inflow and outflow of cash over a specific period of time, usually a quarter or a year.

It is divided into three sections: cash flow from operating activities, investing activities and financing activities.

II. Understanding Cash Flow from Operating Activities

A. Explanation of what cash flow from operating activities represents:

Cash flow from operating activities represents the cash that a company generates from its normal business operations.

This includes cash received from customers, payments made to suppliers, and other operating expenses.

B. Discussion of how to calculate cash flow from operating activities:

To calculate cash flow from operating activities, you start with the net income from the income statement.

Then, you add or subtract any non-cash items, such as depreciation, and changes in working capital, such as accounts receivable and accounts payable.

C. Analysis of how changes in net income, non-cash items, and working capital affect cash flow from operating activities:

For example, if a company’s net income increases, it will also see an increase in cash flow from operating activities.

However, if the company experiences a decrease in working capital, this can decrease cash flow from operating activities.

III. Understanding Cash Flow from Investing Activities

A. Explanation of what cash flow from investing activities represents:

Cash flow from investing activities represents the cash that a company generates or uses from investments, such as buying or selling property, plant and equipment, or other long-term assets.

B. Discussion of how to calculate cash flow from investing activities:

To calculate cash flow from investing activities, you start with the cash inflow and outflow from investments.

C. Analysis of how changes in investments, acquisitions, and disposals affect cash flow from investing activities:

For example, if a company spends a large amount of money to acquire a new division, this will decrease cash flow from investing activities. On the other hand, if a company sells a division, this will increase cash flow from investing activities.

IV. Understanding Cash Flow from Financing Activities

A. Explanation of what cash flow from financing activities represents:

Cash flow from financing activities represents the cash that a company generates or uses from its financing activities, such as issuing or repurchasing shares, or borrowing or repaying debt.

B. Discussion of how to calculate cash flow from financing activities:

To calculate cash flow from financing activities, you start with the cash inflow and outflow from financing activities.

C. Analysis of how changes in borrowing, dividends, and stock buybacks affect cash flow from financing activities:

For example, if a company borrows money to expand, this will increase cash flow from financing activities. On the other hand, if a company pays out dividends to shareholders, this will decrease cash flow from financing activities.

V. Interpreting the Cash Flow Statement

A. Explanation of how to read and interpret the cash flow statement as a whole:

To understand the overall health of a company, it’s important to look at the cash flow statement in conjunction with the income statement and balance sheet.

B. Discussion of how to use the cash flow statement to identify trends and assess a company’s financial health:

By comparing the cash flow statement over multiple periods, you can identify trends in the company’s cash flow and assess the company’s ability to generate cash. This can be a good indicator of the company’s financial health, and can help you make informed decisions about investing in or working with the company.

C. Comparison of the cash flow statement to the income statement and balance sheet:

The income statement shows a company’s profitability over a period of time, while the balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. The cash flow statement, on the other hand, shows the inflow and outflow of cash over a period of time. Together, these three financial statements provide a comprehensive picture of a company’s financial health.

A step-by-step guide to reading the cash flow statement

- Start by reviewing the cash flow statement as a whole. Look at the total cash flow for the period, and determine whether it is positive or negative.

- Next, review the cash flow from operating activities section. This section shows the cash generated or used in a company’s normal business operations. Look for any changes in net income, non-cash items, and working capital that may have affected the cash flow.

- Next, review the cash flow from investing activities section. This section shows the cash generated or used from investments, such as buying or selling property, plant and equipment, or other long-term assets. Look for any changes in investments, acquisitions, and disposals that may have affected the cash flow.

- Next, review the cash flow from financing activities section. This section shows the cash generated or used from a company’s financing activities, such as issuing or repurchasing shares, or borrowing or repaying debt. Look for any changes in borrowing, dividends, and stock buybacks that may have affected the cash flow.

- Finally, compare the cash flow statement to the income statement and balance sheet. This will help you understand the company’s financial performance over a period of time and its financial position at a specific point in time.

- Look for any trends in the cash flow, such as consistent positive or negative cash flow, or fluctuations in cash flow from one period to the next.

- Look for any red flags, such as negative cash flow from operating activities, large changes in cash flow from investing activities, or heavy borrowing from financing activities.

- Keep in mind that cash flow statement is one of the three financial statement and should be read in conjunction with the other statement.

- Look for any additional information the company may have provided in the notes to the financial statements or in management’s discussion and analysis that could provide more insight into the company’s cash flow.

VI. Conclusion

A. Summary of key points:

In summary, understanding the cash flow statement is essential for any business owner. It provides insight into a company’s cash inflow and outflow, and can be used to identify trends and assess the company’s financial health. Check our picks for courses that will help

B. Importance of understanding cash flow statement for decision making:

By understanding the cash flow statement, you can make better financial decisions for your own business, and assess the financial health of other companies you may be considering working with.

C. Suggestions for further study:

To further improve your understanding of cash flow statements, consider taking a course or reading more in-depth resources on the topic. This is an amazing guide from Harvard Business School that definitely will answer any hanging questions you may still have.

D. Glossary

- Cash flow: The amount of cash and cash equivalents being transferred into and out of a business. This can include cash generated from business operations, investments, and financing activities.

- Operating activities: Business activities that are considered to be part of a company’s normal operations, such as generating revenue and paying expenses.

- Investing activities: Business activities that involve the acquisition or disposal of long-term assets, such as property, plant, and equipment.

- Financing activities: Business activities that involve obtaining or repaying financing, such as issuing or repurchasing shares, or borrowing or repaying debt.

- Cash flow from operating activities: The cash generated or used in a company’s normal business operations. This includes cash received from customers, payments made to suppliers, and other operating expenses.

- Cash flow from investing activities: The cash generated or used from investments, such as buying or selling property, plant and equipment, or other long-term assets.

- Cash flow from financing activities: The cash generated or used from a company’s financing activities, such as issuing or repurchasing shares, or borrowing or repaying debt.

- Net income: The profit or loss of a company over a period of time, calculated as total revenue minus expenses.

- Non-cash items: Items that do not involve a cash transaction, such as depreciation, amortization, and deferred taxes.

- Working capital: The difference between a company’s current assets and its current liabilities.

- Income statement: A financial statement that shows a company’s profitability over a period of time.

- Balance sheet: A financial statement that shows a company’s assets, liabilities, and equity at a specific point in time.